There are many different payroll software out there. But which one is the best for your business? Here are five of the best small business payroll software on the market today, and why they’re worth a look.

The wave free payroll software is a very good option for small businesses. It’s free and has some great features like automatic paycheck generation and online tax filing.

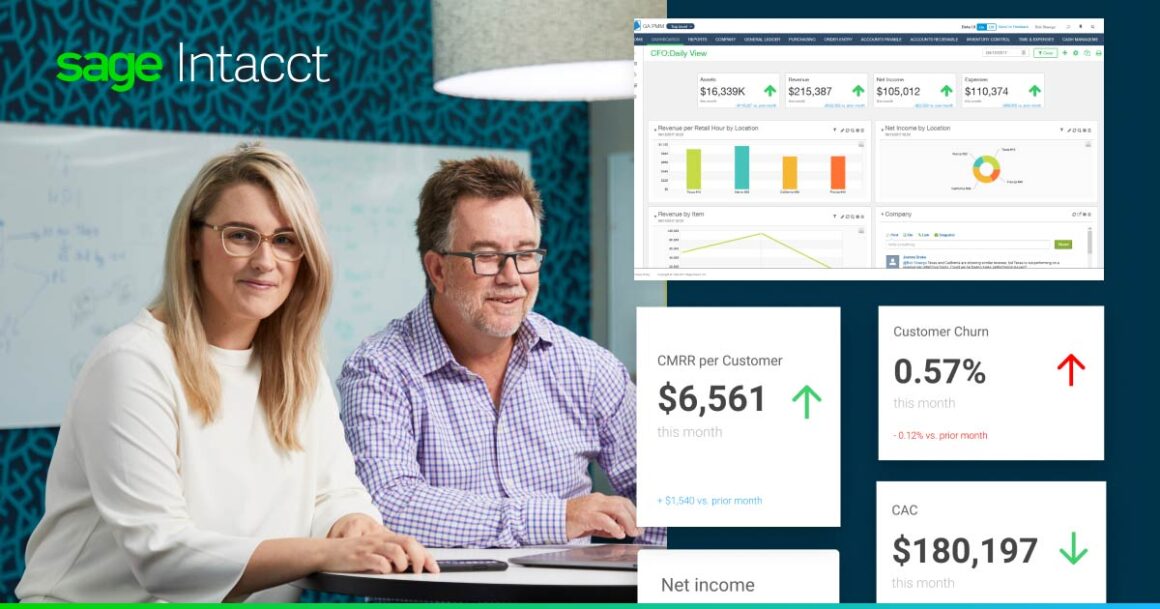

This accounting software is the result of a combination between Sage Group and ERP Solutions, which purchased Intacct, a 19-year-old accounting software business.

Sage Intacct is a cloud-based accounting software., a complete accounting and payroll system, is the product of this combination, which brings together Sage’s knowledge, experience, and world-class quality.

You may use this cloud-based payroll software for small companies to handle cash, purchases, billing, suppliers, revenues, contracts, projects and funding, inventories, and subscriptions, as well as generate financial reports.

It is both adaptable and accurate, with the goal of improving long-term company success and staff productivity.

HR accounting, which includes elements such as payroll, benefits, time tracking, and insurance, is one of the advantages of utilizing this application. Its one, linked payroll system in many locations provides a look into your payroll structure, performance, and activities.

It is also a top financial applications supplier, according to the AICPA (American Institute of Certified Public Accountants), and has won many industry awards.

It also offers a broad variety of accounting features, and you can utilize built-in report templates to build customizable reports that evaluate your company’s performance, track sales, and more.

Sage Intacct

With this powerful ERP software, you can expand your company and manage your money more effectively.

Although this payroll software for small companies lacks the sophisticated features and add-ons of the others mentioned here, its price plan is clear, and it provides basic needs for small enterprises.

Unlimited pay runs, tax filings, deposits, and check printing are all included, as well as a mobile-friendly system that is simple to use and fast. You can complete your payroll in minutes, and its user-friendly interface makes inputting payroll components like as hours, tips, bonuses, and reimbursements a breeze.

It also offers quick load speeds, especially on mobile phones and tablets, and a preview window to check your pay runs to prevent crucial mistakes that may result in tax penalties.

It may also help with compensation and insurance since the program is a certified health insurance broker with fully integrated 401(k) plans.

Employee self-onboarding to save time, automatic new hire reporting to the government on your behalf, online access for workers, assured payroll compliance, and automated payroll taxes are just a few of the HR tasks you may do.

Employees may create lifetime accounts on the tool, which they can access even after they leave your company.

OnPay works with any employee type, and you or your workers may pay without incurring any additional fees by using direct deposit, pre-paid debit cards, or writing your own checks. If you need help, OnPay’s Certified Payroll Professionals are available to help you over the phone.

OnPay

With OnPay, an all-in-one payroll solution, you can increase your productivity and grow your company.

Desktop payroll software for small business is a necessity in the modern world. There are many options available to choose from, but these 5+ best small business payroll software will be sure to help you out. Reference: desktop payroll software for small business.

Frequently Asked Questions

Can I do my own payroll for my small business?

You can do your own payroll for your small business by using a service like Paychex.

What is the easiest way to do payroll for a small business?

The best way to do payroll for a small business would be to use QuickBooks.

Is there a free app for payroll?

There is an app for payroll called Paychex.